Take Your Real Estate Experience to the Next Level

Southwest Colorado’s

Trusted Realtors

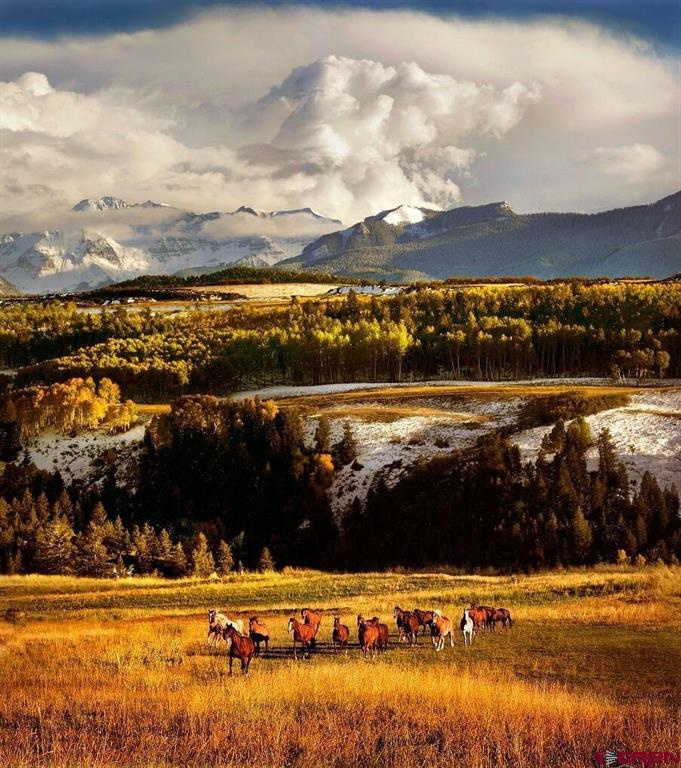

FIND THE LIFESTYLE THAT YOU CRAVE

MOVE ME TO SOUTHWEST COLORADO

Southwest Colorado’s

Trusted Realtors

FIND THE LIFESTYLE THAT YOU CRAVE